- Cybersecurity

- Decisions and knowledge

- Home and Business Experiences

- Personal data

- Sustainable digital society

In a 2011 report entitled “Personal Data: The Emergence of a New Asset Class” [1], the World Economic Forum presented a vision of personal data as the «new ‘oil’ of the 21st century», an epithet which was subsequently widely repeated. In particular, the report predicted that personal data would constitute a new form of currency for individuals – one that they would be free to manage themselves: “In practical terms, a person’s data would be equivalent to their ‘money’. It would reside in an account where it would be controlled, managed, exchanged and accounted for just like personal banking services operate today.”

A few years later, that project appears to be dead in the water. Personal data have undeniably come to play an important role in digital industries: internet users’ everyday lives are now permeated by data capture, with their personal information collected and used to customize advertising, e-commerce sites and services. However, though tracking tools and big data have become widespread, and data brokers have emerged, web users have little grasp of how their data and traces are collected and used, and still less of an idea of how to monetize them. How can we explain this failure of a C2B market for personal data controlled by individuals?

Back in 2010, the idea of individuals monetizing their data drew interest from many quarters. Data protection and the idea of internet users taking back control of their data became a recurring theme for defenders of individual freedoms. At the same time, the possibility of interconnecting services and setting up APIs began to pave the way for greater interoperability between hitherto largely self-contained services (blogs, social networks, etc.).

In that context, it seemed at the time that there was a genuine prospect of a market for personal data in which internet users would make money from selling information about themselves. Such market would not monetize the participation to online panels where users answer questions or test products, but would deal in particular with behavioral and browsing data, and it could be massively deployed to the whole population of internet users. Consequently, some players set about attempting to give shape to such a market.

GAUGING THE VALUE OF PERSONAL DATA THROUGH THE PRISM OF PRIVACY

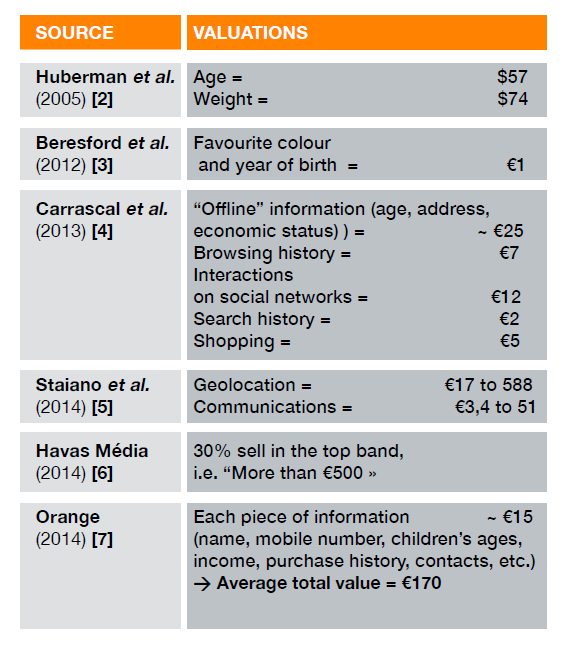

In order to sketch the outlines of a possible system in which internet users would sell their personal data, several studies attempted to estimate the value of personal data by looking at the matter from the perspective of the provider, i.e. the web user.

These economic experiments all took the same approach, immersing internet users in fictitious situations in which they had to weigh up the cost of disclosing information about themselves (age, income, internet history) against a financial benefit (discounts, sale of data, etc.). The value of data was thus defined as the price – or its equivalent in service terms – at which individuals would be prepared to transfer certain personal data and thus sacrifice their privacy. The aim of these initial valuations was to identify the data whose protection individuals valued most highly, as well as the third parties to whom they would consider selling them, and at what price (see table). Another shared feature of the studies was that they all considered value in an atomized way: an amount was associated with each piece of information (age, year of birth, contacts, etc.).

Summary of studies on the value of personal data for individuals

The study conducted by Carrascal et al. in 2013 [4] is a good example of the kind of work done. The experiment was based on a plugin developed for web browsers, which, in real time, asked a panel of participants (n=168) at what price they would be willing to sell information about their behaviour and practices on the web. ‘Offline’ information (age, address, economic status) had a high price, at around €25. The average price for browsing history, meanwhile, was €7, with variations depending on the information (€12 for interactions on social networks; €15.50 for visits to financial sites; €2 for search history; €5 for shopping).

The prices cited by internet users in studies of this type are high — in the region of a few euros. In this regard, the studies show that, in principle, web users consider it relatively important not to disclose certain pieces of information about themselves. In addition, the practical conditions of the provision of data by individuals are rarely made clear in these tests: would it be a firm and final sale, a lease arrangement, or a single-use transfer? Who would buy these data? And what for? These scenarios posit the existence of an open market for personal data. But does this C2B market for personal data really exist?

SOME PROMISING SERVICES

Some companies have explored this path, banking on the idea that digital players would respect the need to seek users’ consent to provide their data, and on the notion of attaching proprietary rights to personal data.

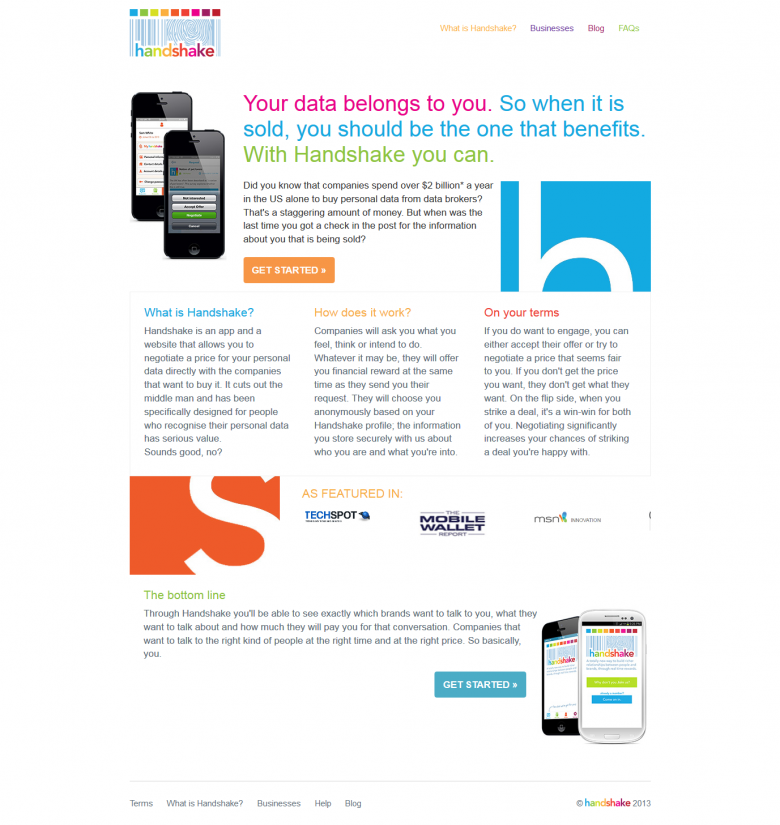

We have identified five such players, in the United States (Personal, Datacoup, Personal Black Box), the United Kingdom (Handshake) and France (Yes Profile). At the same time, between 2009 and 2013, artists and performers were also putting their traces on the market as a way of questioning the tracking and monetization of web users’ digital lives. In the wake of the US Federal Trade Commission’s 2010 report on the implementation of ‘Do Not Track’ to limit ad targeting, the tracking issue was widely discussed in the mainstream media. A few years later, the subject was in the news once again, when, in 2013, the US Senate published a detailed report on data brokers, large-scale operators that amass huge bases of personal data and sell access to them. It seemed, then, that the time was about to be ripe for the emergence of a market that gave internet users the freedom to sell their own personal data.

In this context, our five start-ups all used the same pitch, which can be summed up as follows: the internet giants make huge profits by monetizing their users’ personal data without their knowledge, web users should be able to get this value back. The model adopted by these companies involved asking internet users to entrust them with data from social networks, as well as entering a considerable amount of additional information about themselves, particularly about their purchase intentions, or even taking part in focus groups and testing products. The potential gains these start-ups promised to web users were in some cases highly exaggerated: Handshake suggested profits could reach £15,000 (€19,000) per participant per year; Yes Profile estimated potential monthly income at €60 to €100, giving an annual total of up to €1200; and Personal Black Box gave a range from $50 to $500 (€45 and €450). Datacoup, meanwhile, was more cautious, with its site advancing the figure of €8 a month, or around a hundred euros a year.

REASONS FOR FAILURE

These services never took off. Ultimately, they came up against one major stumbling block: advertisers do not need to turn to internet users to access information that they already systematically obtain directly through their websites and applications (data from CRM databases, behavioural data from their site), or indirectly through advertising and marketing players.In these cases, the user’s consent is either superfluous or implied.

Companies which, like Yes Profile, promise individuals the opportunity to “own their profile again” are unable to keep this promise: signing up on the site and providing your personal information does nothing to stop capture by other players (advertising agencies, ad exchanges, data brokers, etc.), and the profiling done by Yes Profile only adds to the tracking individuals are subjected to; it does not replace it. In consequence, the C2B market for personal data has never really taken off, and the start-ups that have tried to create it are either doing negligible business.

Handshake (handshake.co.uk) home page

A FEW CENTS

Even if internet users were to take back control of their data and their traces and try to make money out of them, the self-valuation of personal data would come up against another major constraint: on existing markets, these data are not worth much.

Calculations from two sources based on the rates used on the advertising market provide support for this observation. The Financial Times was the first, in June 2013 [8], to create an interactive online questionnaire enabling readers to assess the value of some of their personal data (sociodemographic information, assets, leisure pursuits and consumption patterns) based on effective prices from US data brokers. Question after question, the tool demonstrates how interest in personal data differs from sector to sector. Plans to go on holiday or buy a car, or the impending arrival of a new baby in the household, will raise the value of a profile because such details are of particular interest to certain advertisers. That said, these characteristics only increase the total value of a profile by a few cents or tenths of a cent, with the average total value running at around 20 cents.

A second empirical study [9], conducted by the Privatics laboratory of the French National Institute for Research in Computer Science and Control (INRIA) in 2014, sheds additional light. In their observation of purchase prices in online advertising auction systems (known as “RTB” or Real Time Bidding), the authors report that prices vary according to the temporal depth of the information accumulated about an internet user through cookies. Clues to purchase intention attract higher valuations than simple profiles based purely on browsing history. Browsing history itself is only valued at around $0.0005 for an advertising impression. The authors estimate the volume of business generated at $0.18 per month. Web users’ potential earning on this market would be around $0.432 per year. Almost nothing, in other words.

A DISPOSSESSED WEB USER?

These studies show two things: firstly, that the value of a set of personal information, when determined by the rules of supply and demand on the advertising market, is always low, and unattractive for consumers. Secondly, they show how the market for personal data operates and what its products are: it is a B2B market for purchase intentions, qualified profiles and lists of individuals, formatted for the needs of advertisers and a highly automated industrial chain.

What, then, does that leave for the web user, whose data are widely collected without any real informed consent and would in any case make them no money? We should assess the value of personal data for the individual in terms not of its monetary value, but of its usage value, and that we should separate this question from the privacy issue. The information and traces held by digital players about their customers are starting to be made available to those customers, in the form of dashboards (Google) or lists to be exported, and generally contain profile information and transaction histories (Orange, e-commerce, etc.). For the digital industries, giving web users the capacity and the infrastructure to recover these data and make them actionable by thirdparty applications, while respecting their privacy, now appears to be a fruitful avenue for extracting value from data through usage and services.