The need to integrate smart systems in the automotive sector

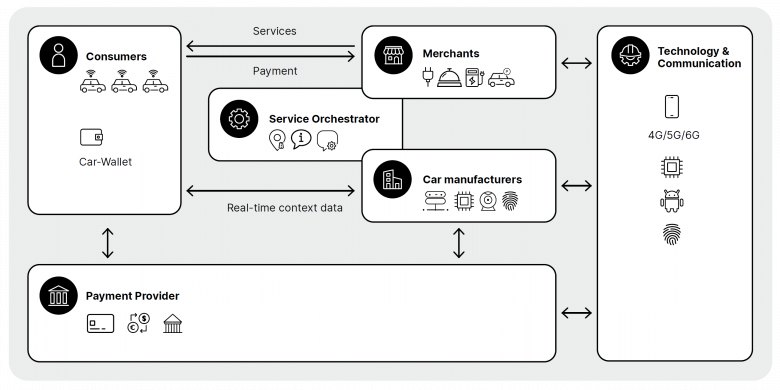

In the wake of a global energy transition, the automotive industry is undergoing a massive transformation, driving the emergence of disruptive business models. For many key stakeholders in the in-vehicle ecosystem, including car makers, retailers, payment providers, banks, telcos and technology firms, new opportunities are appearing for them to offer the best customer service. In this context, an open ecosystem providing secure and frictionless payments will help drive revenue, reduce costs and increase satisfaction.

This white paper paints a picture of an ecosystem-based approach as the one most likely to create open cooperation between all actors in the value chain.

The ongoing digitalization in several fields is having a significant impact on the automotive sector, with vehicles now natively connected and offering sophisticated interfaces and on-board digital services. In-car payment is one such service, which aims to enable motorists to carry out transactions related to their needs while on the go. This involves leveraging the embedded technologies found in modern vehicles to facilitate transactions with third-party services, using the car’s interfaces and connectivity to provide a seamless experience.

A white paper on the market, the roles of individual players and the stakeholders

Worldline and Orange researchers have created a white paper collating current knowledge of in-car payment, which promotes an open approach. This white paper explores the concept of in-vehicle commerce, which encompasses all sorts of transactions for vehicle-related goods and services: refueling or charging, fees for open or secure parking, highway tolls, ferry tolls, drive-through purchases, roadside assistance and maintenance, in-car purchases of multimedia content or subscriptions, etc. — without forgetting the new types of services that are expected to emerge in the future, such as payment for the use of expressways, car pooling, dynamic management of urban infrastructure, advance bookings on highways, etc. The global market for these transactions, which was approximately $1.12 billion in 2022, is projected to grow to more than $6 billion by 2030.

Rapid electrification and the explosion of digital technology on board new vehicles are redefining the personal transportation experience. Alongside the familiar navigation and infotainment services, as well as the regulatory emergency call feature known as eCall, new digital functionalities are emerging such as remote monitoring, voice interaction and, in the near future, V2X (vehicle-to-everything) services, which use interconnectivity between vehicles and with infrastructure to improve safety. The availability of on-board digital interfaces is also reshaping the commerce landscape. Highway operators were the first to implement automated payment technologies for their services, but today many players have an interest: car makers and parts manufacturers of course, but also merchants (fuel providers, parking operators, car wash and maintenance networks, etc.), digital operators (bigtechs and telcos) and the payment industry (banks, card networks and fintechs).

This white paper also features interviews with industry experts (Cédric Cagna, Director, EY Consulting Services; Mark Gerban, Digital and Payment Expert, member of AutoTech Europe; and Franck Leveque, VP Bridgestone Mobility Solutions) to complement the analysis by exploring market potential and keys to success, partnership opportunities for car manufacturers in the value chain and, more generally, the challenges presented by the large-scale rollout of this kind of solution. The document concludes with some key takeaways for each player in the in-vehicle commerce value chain, outlining the achievable benefits and the strategic choices to be made so that these players can work together and effectively to create this sustainable ecosystem.

Challenges

The ecosystem that is taking shape is a complex one. So far, in-vehicle payment solutions have mostly been experiments, sometimes on a large scale, carried out by car manufacturers, oil companies and infrastructure operators. They have all used so-called silo approaches, which are inherently limited in terms of compatible technology and what they can offer. This reveals the need for a more open ecosystem that would allow more players to share the value in the business chain, providing enough space for everyone and making it easier to develop and adopt services. There is also the question of the role of the cell phone in the technology chain compared with more integrated solutions from car makers and parts manufacturers.

To conclude

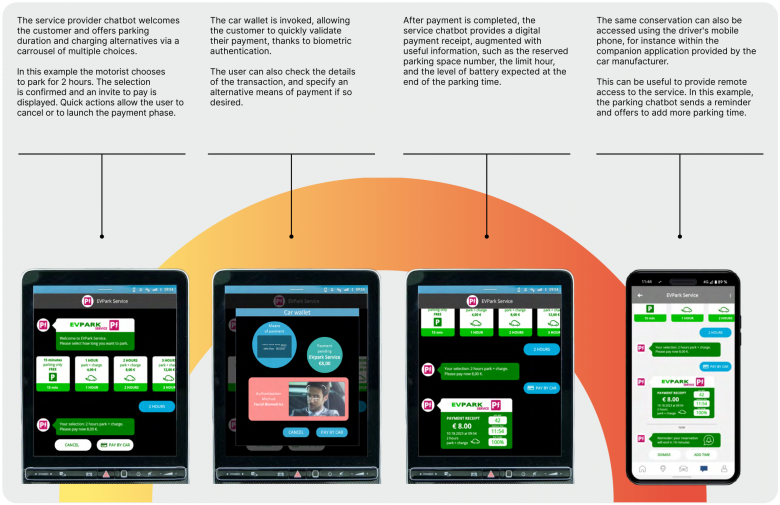

“In-Vehicle Commerce: Revolutionising payments and business on the move,” a white paper co-authored by Orange and Worldline, paints a picture of an ecosystem-based approach as the one most likely to create open cooperation between all actors in the in-vehicle payment value chain, avoiding the pitfalls of silo approaches. Doing things in this way makes use of chatbots, leveraging global rich messaging standards to provide a conversational interface between the user and all kinds of services, in an approach based on opportunity and without prior registration (see image below).

With this approach, merchants have a great deal of flexibility when designing their products and services, and can control user dialogue and interaction. Users benefit from ease of access to all available products and services, without the need to install any particular application or create a customer account upfront. This type of interaction would be smooth, rich and adapted both to on-board interface capabilities and to inherent in-car safety constraints. Car manufacturers and/or vehicle operators (fleet managers, rental companies) can obtain value during a commercial transaction through the use of their systems by controlling access to vehicle interfaces, while also reducing their digital costs. Payment providers can operate an in-car wallet, which can take the form of a cloud wallet and contain several payment methods. Technology partners, particularly telcos, provide and optimize the interoperable rich communication assets (business messaging platform and channel, chatbot design and hosting tools, service directory).

Sources :

White paper (PDF): https://hellofuture.orange.com/wp-content/uploads/sites/56/2023/12/WP_Worldline_Orange_In_Vehicle_Commerce_2023.pdf

Read more :

The white paper on the Worldline website: https://worldline.com/en/home/main-navigation/resources/resources-hub/publications/in-vehicle-commerce-revolutionising-payments-and-business-on-the-move.html