Summary

In sub-Saharan Africa, the huge majority of businesses belong to what is known as the “informal” sector, which is a major player in the digital upheaval that the African continent is going through. Senegal is a good example of this intertwining of informal and digital. With the support of Orange, who is established there via its Sonatel subsidiary, researchers from the « Les Afriques dans le Monde » laboratory (LAM – CNRS – Sciences Po Bordeaux) carried out an unprecedented study in 2017 in Dakar. Four types of informal production units were thus identified: “small survival informal” (29% of the sample), “top performers” of informal (22%), “inexperienced gazelles” (21%), and “mature gazelles” (28%). In parallel, four profiles of professional mobile usage in the informal economy emerged: simple usage entrepreneurs (32%), connected entrepreneurs (22%), networking entrepreneurs (27%), and digital entrepreneurs of the informal (19%). When comparing these two classifications, we see a strong polarisation that opposes the simple usage entrepreneurs, strongly represented within the “survival informal”, and the digital entrepreneurs, who are to be found mainly amongst the “top performers”. However, the capacity of mobile technologies to enable the « gazelles » to overcome obstacles to their development remains to be investigated. The next wave of study will be carried in Dakar in 2019.

Full Article

In sub-Saharan Africa, the vast majority of businesses are part of the “informal” sector. The specific features and diversity of these businesses – small, under-capitalised, no standard accounting system – are well-known and researched. But very little is known about how these businesses have taken on board new technologies, which have become part of their day-to-day lives on a massive scale in less than a decade. This context invites us to look into the specific uses of mobiles by entrepreneurs from this sector: what types of professional mobile use do they prefer? How does this impact their production unit’s productivity and performance? This is the focus of an ambitious research project launched in 2016 by the think-tank « Les Afriques dans le Monde » (LAM – CNRS – Sciences Po Bordeaux), with support from Orange Labs, and its initial findings are presented here [1].

Development of digital and the informal sector in Africa

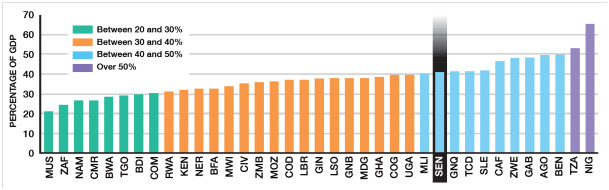

The digital transformation taking shape across the African continent is raising major expectations for its potential benefits in terms of growth, innovation and structural change for its local economies. The number of active SIM cards in Africa grew from 12.4% of the population in 2000 to 74.6% in 2016, while the number of people using touch-screen phones climbed from 1.8% in 2010 to 22.9% in 2016 [2]. This technological transformation is also moving forward and developing strongly in certain parts of the “informal sector”, which a large part of the population work in. According to the International Labour Office, the informal sector accounts for nearly 70% to 80% of non-agricultural jobs, with a majority of self-employed people and micro-enterprises. Carried out partially outside the framework of public regulations, these extremely diverse informal activities (crafts, repairs, dining, small traders, etc.) have seen rapid growth in the last few decades, particularly in urban environments. Today, estimates show that they contribute 25% to 65% of the GDP of sub-Saharan economies according to the IMF (Figure 1).

Figure 1: estimates for the informal economy in sub-Saharan Africa, average for 2010-14

Senegal clearly illustrates these links between the informal sector and digital technology, with a number of active mobile phone accounts equivalent to the country’s population and an informal sector that accounts for 97% of production units (businesses) [3]. Orange is present in Senegal through its subsidiary Sonatel, the country’s leading operator. That is why a ground-breaking quantitative survey was carried out there in 2017, covering a representative sample of 500 businesses from the Dakar region’s informal sector [4]. This survey made it possible to build up a detailed picture of various aspects, including the revenues, workforce and capital of businesses that do not have any formal accounting records. The survey participants were also asked detailed questions about their equipment and their internet and phone use. In addition to the questionnaire with these 500 businesses, focus groups were set up for individual and collective qualitative interviews involving around 50 of them.

The initial analyses made it possible to identify and characterise a typology of businesses from Dakar’s informal sector and the different profiles for mobile use by informal entrepreneurs.

Between survival-based informal and top performers, gazelles with untapped potential?

An initial statistical analysis, focused on the features of entrepreneurs and businesses, reveals that Dakar’s informal sector is highly diverse. More specifically, four types of informal production units have been identified.

An initial distinction differentiates very clearly between “small-scale survival-based informal” activities (29% of the sample) and the informal economy’s “top performers” (22%), two segments that are already well identified in research and have contrasting features. The first group is made up primarily of self-employed individuals and very small businesses that are extremely precarious and poor performers, operating mainly in the food transformation and sales sectors. Contrasting with this, the second group is characterised by relatively large businesses (80% of these informal businesses have more than five employees) with high levels of capital. These are well-established businesses, often involved in production, that keep relatively detailed accounting records and achieve significantly higher economic performance levels than the other segments. The heads of these businesses do not necessarily have high levels of education, but they achieved the highest scores in the survey’s entrepreneurial behaviour and cognitive tests.

Between these two extremes, the statistical analysis reveals an intermediate segment of gazelles operating with similar levels of capital to the top performers, but with far weaker performances. This set is described in the development economics literature as “gazelles”, to highlight the mixture of dynamics and fragility that characterizes these companies. The survey reveals the presence of two subgroups.

The first subgroup of “inexperienced gazelles” (21%) is characterised by entrepreneurs who are younger and less experienced, but have high levels of education. Their activities are more recent and they can often be found in the trade sector. The second subgroup of “mature gazelles” (28%) is made up of older entrepreneurs with more stabilised and established activities. While their levels of education are lower, they scored highly in the cognitive tests and their entrepreneurial behaviour stands out very clearly. They are found primarily in service-based activities.

Four profiles for entrepreneurial mobile use in Dakar’s informal sector

A statistical analysis of professional mobile uses was carried out separately, with the sample of 500 businesses from Dakar’s informal sector.

This diversity was looked at based on several dimensions:

- Equipment (simple GSM phone or touch-screen phone and smartphone);

- Main professional features for which mobiles are used [5]: i) bilateral coordination (one-to-one with suppliers, customers, partners) or multilateral coordination (one-to-many online, searching and sharing information, promotions and sales); ii) use of mobile money services such as Orange Money (making payments, sending and receiving money, savings); iii) use of their mobile for internal management (accounting, inventory and account management, management of staff);

- Diversity of uses, assessed based on the number of applications and interfaces that an entrepreneur uses (voice, instant messaging, social media, video calls, etc.);

- Intensity of uses, which corresponds to the frequency of using the various features identified.

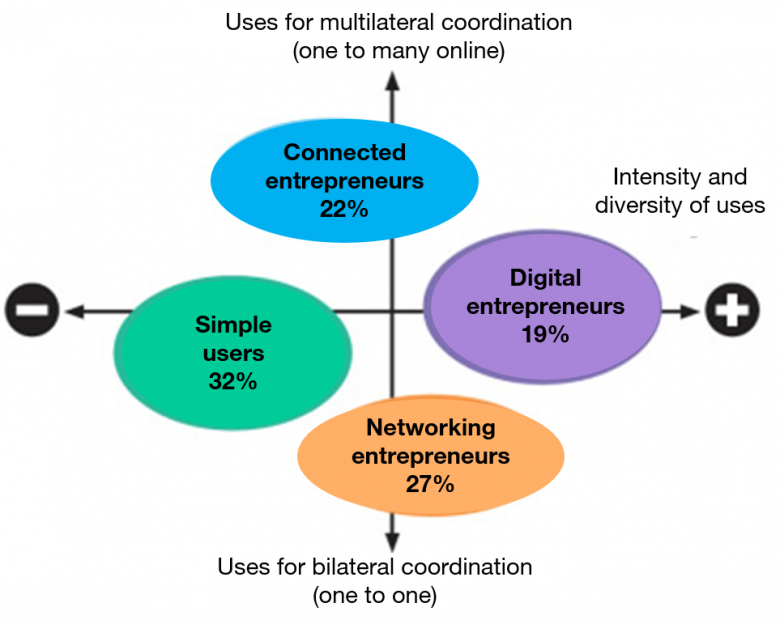

The statistical analysis of the variables associated with each of these dimensions has made it possible to identify four very distinct user profiles, illustrated in Figure 2 below.

Figure 2: mobile user profiles in Dakar’s informal sector

Figure 2: mobile user profiles in Dakar’s informal sector

The horizontal axis clearly shows the contrast between “entrepreneurs with simple mobile uses” and the “informal sector’s digital entrepreneurs”. The entrepreneurs from the first group very rarely have a smartphone (less than one in four) and their professional mobile use is very limited. On the other hand, the “digital entrepreneurs” show extremely advanced and intensive mobile use in connection with their businesses. They use their mobiles to carry out almost all the possible functions and with all the interfaces available. To do this, they all have a touch-screen mobile or smartphone. Nearly two thirds of them even promote their business and sell their goods and services online.

In the intermediate position in terms of the intensity and diversity of their uses, we can see “networking entrepreneurs” and “connected entrepreneurs”, who are at opposite ends of the scale on the second axis. The first group are particularly dynamic in terms of bilateral coordination with their customers, suppliers and partners. In other words, they use their phones – for 60% of them, this is a touch-screen phone – daily to communicate one-to-one by voice or in writing with their business contacts. However, they very rarely use the internet in the context of their business. Touch-screen phones are far more popular with the connected entrepreneurs. 90% of them have one and they stand out primarily through their internet use: 90% of them use it to look up information, while 40% sell and promote their business online. In this area, their uses of Facebook and WhatsApp are particularly well developed.

Mobile phones providing help for gazelles

These initial findings provide some insights into the link between mobile uses and performance for informal micro-enterprises and small businesses in an African context. When we compare our two typologies (Table 1 [6]), we can see a highly polarised situation, with simple use entrepreneurs strongly represented in the survival-based informal sector on the one hand, and on the other hand, digital entrepreneurs, who tend to be among the top performers.

This confirms that everyone is not benefiting in the same way from the potential offered by mobile phones, if only because of the barriers that exist in terms of the ability to adopt the various features they offer, whether financial (smartphone access) or cognitive (knowledge and skills required to make full use of them).

Mobile uses show more contrasts among the gazelles. Our inexperienced gazelles include the same number of connected entrepreneurs as digital entrepreneurs. This is notably linked to the features of these gazelles, with entrepreneurs who are more often young and have relatively high levels of education compared with the other segments. Among the experienced gazelles, it comes as no surprise to see that the networker entrepreneur profile appears more often, as they are better integrated on the market. However, these gazelles lag far behind the top performers in terms of their economic performance levels. Proof, if any were needed, that mobiles on their own do not provide any miracle solutions to strengthen economic performance for businesses from the informal sector.

Table 1: user profiles and informal economy segments

The capacity of mobile technologies to enable « gazelles » to overcome the obstacles to their development still needs to be looked into, factoring in both the external constraints that these businesses must take on board and the (un) suitability of the mobile services offered in the specific context of their activities. Further work is underway, with continued support from Orange’s research division, looking to answer these questions. A second wave of surveys will be carried out in Dakar in 2019. It aims to research the dynamics of theses gazelles and trends over the last two years, covering both economic performance aspects and changes in their digital practices. This new survey will also explore other aspects of the digital practices of entrepreneurs from Dakar’s informal sector: the overlapping of professional and personal mobile uses, and the links between digital practices and having multiple activities, a widespread reality and clearly under-researched feature of the informal economy.

Learn more:

[1] For further details concerning the results presented here (particularly in terms of methodologies for the collection and statistical analysis of data), readers can refer to the report available at: http://v-labosense.rd.francetelecom.fr/sense/SENSE-ETUDES/SENSE%202018/LAM_ORANGE_3_2018_04.pdf

[2] Source: ITU (2017), Measuring the information society. Volume II, ICT country profiles. Two precautions need to be taken when interpreting these data. Firstly, the number of touch-screen phones is measured based on the number of mobile broadband subscriptions. Secondly, it is common practice in Africa to have active SIM cards from the various rival operators. According to our estimates, taking into account the number of mobile operators in each country to mitigate the impact of the multiple-SIM phenomenon, the average mobile penetration rate would be reduced by more than half. In addition to this adjustment, it is important to note that mobiles are usually shared between several people, which means that the actual level of mobile use will be underestimated. The measurements that are not suited to these practices make it difficult to accurately estimate the level of mobile penetration in this region.

[3] National Agency of Statistics and Demography (ANSD), Summary of RGE results. ANSD, Dakar, Senegal. 2017

[4] The informal sector includes production units that are not registered and/or do not have formal written accounting records complying with West African accounting standards (SYSCOA).

[5] For a detailed presentation, see our review of this subject: Les petites entreprises informelles africaines au défi des technologies numériques

[6] This table shows a simplified, schematic presentation of the results of a Khi2 test per case. The “+” symbol indicates that a case is statistically significantly overrepresented (threshold of 5%).