As the ways in which we use digital technology to manage our finances grow, so do the risks associated with making payments. The Annual Report 2021 from the OSMP (Observatoire de la Sécurité des Moyens de Paiement — Observatory for the Security of Payment Means) reveals some startling figures. Namely, there were 7.5 million fraudulent transactions in 2021, worth a total of €1.24 billion. Although these figures have decreased slightly compared with 2020 (by 3.8%), those associated with attempted fraud continue to rise.

These figures are just a snapshot of payment fraud in France. Indeed, we cannot understand the true extent of this phenomenon without taking the feelings and experiences of victims into account. However, of late, very few studies have explored fraud from this alternative perspective. With a view to digging deeper into the matter, a large quantitative survey of fraud victims was launched this year. This is the first survey in France to provide an insight into how people became victims of bank fraud, whether they fit a particular profile and what their experiences were like.

At the Research and Innovation Exhibition in October 2022, a first conference on French bank fraud victims was held.

A Better Insight Into the Victims’ Experience

In the fields of sociology and criminology, this type of quantitative victim study is called a victimization survey. It is a statistical survey technique that involves asking a representative sample of a country’s population about the crimes committed against them. This survey is a chance to look at bank fraud in France from a different perspective and complement what we know from the OSMP figures.

The online study was conducted in two phases in July 2022, in collaboration with Orange Bank and the research institute OpinionWay. We have compiled the main results of this survey for you in the embedded infographics.

First, a scoping study needed to be carried out to determine prevalence and the target profile. A sample of 1000 French people aged 18 and over (representative of the population in terms of gender, age, socio-professional category and place of residence) were interviewed using the CATI (computer-assisted telephone interviewing) technique. A second ad hoc study was then carried out on 1000 French people aged between 18 and 75 who had been victims of bank fraud at least once in the last 12 months. They were interviewed online using the CAWI (computer-assisted web interview) technique.

For the purposes of this quantitative study, bank fraud was examined in the context of the victims’ private lives. “Bank fraud” should here be understood as using fraudulent means, namely a scam (for example, a scam in classified ads, social engineering or a romance scam), the theft of a payment method (for example, a checkbook or bank card) or the theft of bank details (for example, a bank account number or routing number) in order to make a payment, transfer or a direct debit without the consent of the account holder.

Unfair trading practices (for example, purchased goods that are not delivered, not as described or past their expiration date) have been deliberately excluded. This is because victims of such offenses must claim compensation from the seller and not the bank.

A Phenomenon Affecting All French People and All Banks

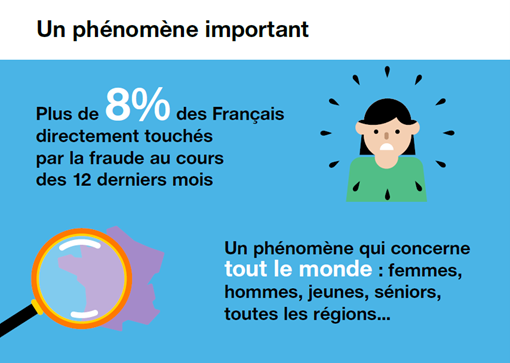

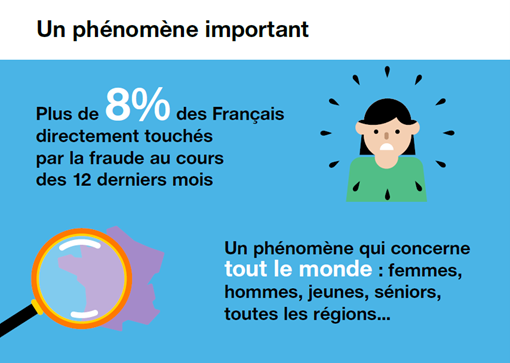

The first key figure revealed by this victimization study is the prevalence of bank fraud in France in 2022, that is, 8.4% of the French population said they had been a victim of bank fraud in a personal capacity at least once during the last 12 months. The payment methods concerned were primarily cards or those directly involving bank accounts (transfers and direct debits).

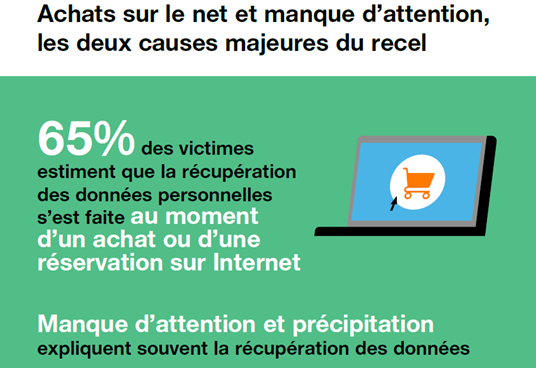

The theft of bank details or payment methods was the most common type of fraud, followed by scams in classified ads. Online purchases made with a bank card are the main transactions targeted by fraudsters. And customers are most often first alerted to fraudulent activity by their bank statement.

Fraudsters obtain personal data via phishing, which involves posing as a reputable entity or person via a website, text message, email or social media page to trick the victim into providing their personal information.

Although there are many victims of bank fraud, it is difficult to profile the typical victim because the entire French population is affected by this issue: women (48%) vs. men (52%), young people (35%) vs. seniors (11%), people in a lower socio-professional category (37%) vs. those in a higher socio-professional category (30%), people across all regions of France.

It is interesting to note the seasonal nature of this fraud, which peaks during summer holidays and in spring following the end-of-year celebrations.

All banking institutions are affected by fraud, although traditional banks seemingly a little less so than online banks or neobanks.

A Heavy Financial Toll

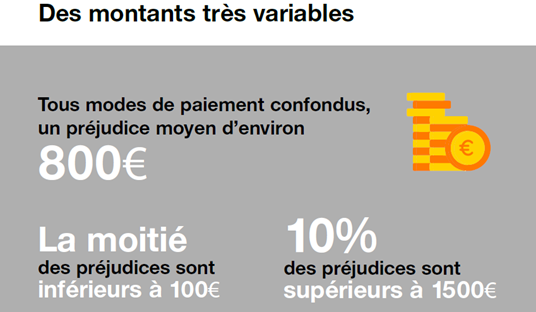

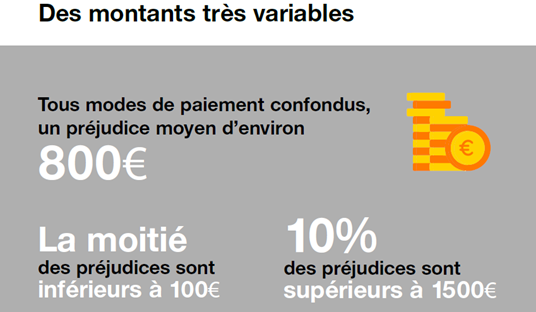

Around 75% of fraud victims suffered a financial loss as a result — €762 on average (standard deviation: 2606; median: 80; maximum: 45,000). Some 55% of these fraudulent transactions were for an amount below €100. But the losses declared were sometimes as high as €45,000.

No payment method is safe from fraud, with direct debits and cards proving the worst affected: €270 was lost on average for direct debit payments, €199 for credit cards, €142 for transfers and €73 for checks. Banks reimbursed 75% of victims.

Confusion, Surprise, Distress

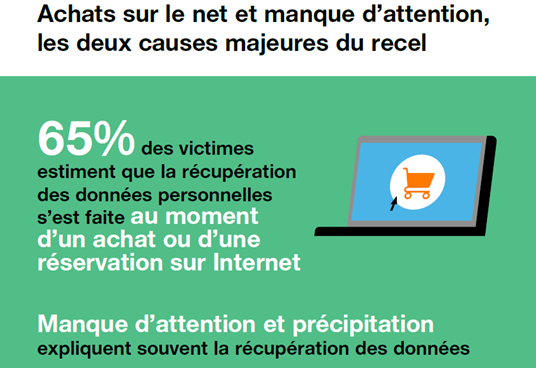

In recounting how they came to be defrauded, victims describe how fraudsters create a context that leads victims to “fall into the trap” whether in real time over the phone or later by email, text message or on a website. Fraudsters establish a climate of constraint (a deal of the day, “we were unable to deliver your parcel,” “help one of your loved ones,” etc.) or trust (“I’ll help you, don’t worry,” “congratulations, you’ve been selected…,” “spare a couple of minutes and earn a prize,” “your order has been shipped, click here to check its status.”). They apply the kind of psychological pressure that makes victims act hastily and allow themselves to be manipulated.

Victims say that bank fraud often occurs due to a lack of attention on their part, but scammers may also take advantage of the financial or psychological problems faced by their targets.

In some cases, fraud occurs without the victims realizing it and other victims find themselves caught up in it against their will, yet this is often swiftly followed by a dawning awareness, or a persistent and troubling sense of doubt or worry. Realizing, too late, what they have just done can have a dramatic impact on some victims.

Fatality is another feeling expressed by many victims. “Beware, we can all be fooled!” warned one respondent. And in the words of another, “Bank fraud is inevitable, you just have to learn to live with it!”

The Impact of Fraud on Digital Behavior and the Banking Relationship

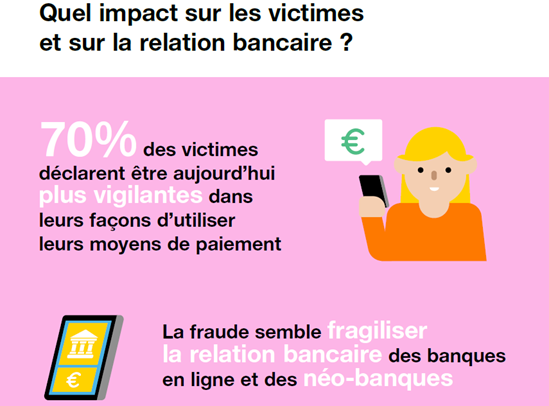

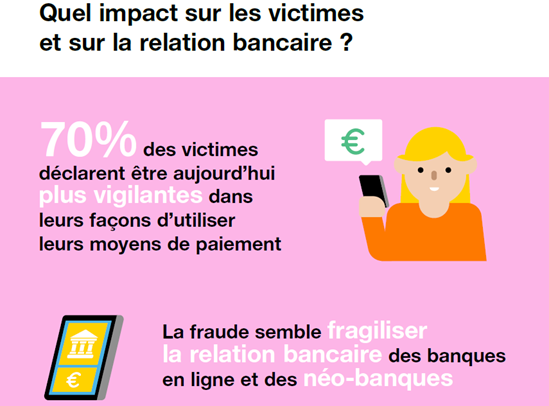

Victims say that they are more vigilant in their digital behavior after being defrauded. Some have even reduced their use of digital technology to limit their exposure, for online purchases in particular.

Fraud has a significant impact on all banks’ relationships with their customers — and this is especially true for online banks and neobanks. The reputation of these banks suffers greatly when their customers become victims of fraud. Such customers are less likely to recommend them and more likely to leave them compared to customers of traditional banks.

When it comes to anti-fraud solutions, victims expect a lot. French people are already familiar with the 3D Secure or strong customer authentication system, introduced a few months ago. It is perceived positively as reassuring, secure and easy to use.

Bank Fraud: What Role Does Orange Have to Play?

The results of this survey of fraud victims that we have just outlined are very valuable to Orange and will help it take action in three key areas:

CSR (Corporate Social Responsibility) — protecting customers by preventing fraud more effectively and providing them with the relevant digital and financial education.

Technology — fighting digital fraud by providing innovative technological solutions that make use of telecommunications carriers’ assets.

Deepening the expertise of Orange and Orange Bank employees — helping employees to easily identify fraud and provide the best possible support to the customers who have been victims of it.

With a view to fighting fraud and as part of its research into customer security and trust in the digital environment, Orange Innovation continues to investigate victims’ perspectives to better understand them and to explore potential technical solutions based on Orange’s assets as a carrier. Just what solutions it has in mind will be revealed in a future article.

The full results of the survey discussed above are available on request.