Online participation happens when web users get involved in online activities on an amateur basis (crowdfunding, citizen science, participatory product design, digital commons, etc.). Implicitly, these activities are meant to be non-market activities. Most studies on online participation look at the phenomenon either from the web users’ side, by studying individual and collective forms of participation, or from the point of view of the businesses that construct and exploit the economic value of this participation (ratings and reviews, etc.).

Here, we would like to analyse collaborative consumption, a sector of the digital economy in which these two dynamics intersect. This innovative form of market transaction is characterised by the online matching of non-professional supply with non-professional demand: consumers can rent out or swap their homes (AirBnB, CouchSurfing, TrocMaison), sell their artistic creations one by one (Etsy, A Little Market), offer car shares (Blablacar), hire services for micro-tasks (Fiverr, Amazon Mechanical Turk), and refresh their wardrobe by selling or exchanging their clothes (VideDressing, TrocParty). The collaborative consumption sector encompasses a wide range of goods and services, all managed by private individuals. These individuals are connected by websites which provide an overall framework for the transactions.

Case study

Launched in 2010, Drivy was the French leader in the sector in 2015. It is now consolidating that position and expanding across Europe. In June 2015, the site had a fleet of 26,000 vehicles in France. By way of comparison, professional car rental firms (Ada, Avis, Hertz, etc.) have a combined fleet of 220,000 private cars. Like other P2P car rental sites such as OuiCar, RelayRides and GetAround, Drivy allows car owners to put their vehicles up for rental on its site, handles the financial and insurance aspects, and takes a 30% commission on the transactions.

To summarise the participatory dynamics at work on Drivy, we have combined four different source materials:

- 1) a functional analysis of the site: presentation of the offer, profile pages, framing of the offer, etc.;

- 2) an interview with Drivy’s communications officer;

- 3) 12 interviews with users in Paris and Lille, including 8 vehicle owners;

- 4) a dataset on the vehicle offer in May 2014, the transactions performed on that fleet and the profiles of the site’s users, constituted from drivy.com using ad hoc tools.

Forms of participation in P2P car rental

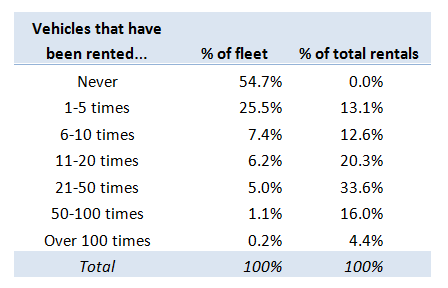

Rental activity is very unequally distributed across the offering. First of all, it is concentrated on a small number of vehicles. Of the 11,000 vehicles available in May 2014, 55% had never been rented, while 25% had been rented between 1 and 5 times. The 140 cars rented over 50 times accounted for 1.3% of the available fleet, and 20.4% of all rentals. A minority of owners are therefore central to the operation of the service.

Vehicle fleet in May 2014 and rental activity.

For renters, renting a vehicle via the site remains an occasional occurrence, with the mean number of rentals just 2.2 a year, and the median 1.4. On Drivy, then, there is an imbalance in participation between supply and demand. The fact that renters use the site relatively infrequently is consistent with a view of collaborative consumption as an “amateur” exercise. On the supply side, meanwhile, over half of transactions are performed by owners who are well versed in the exercise and who exhibit a “pro-am” profile, making use of calculations, standardisations and routines as they intensify their activity.

Drivy and the domestication of participation

Drivy’s fundamental task is to foster this dual dynamic of rental providers and rental seekers and to turn it into a structured market.

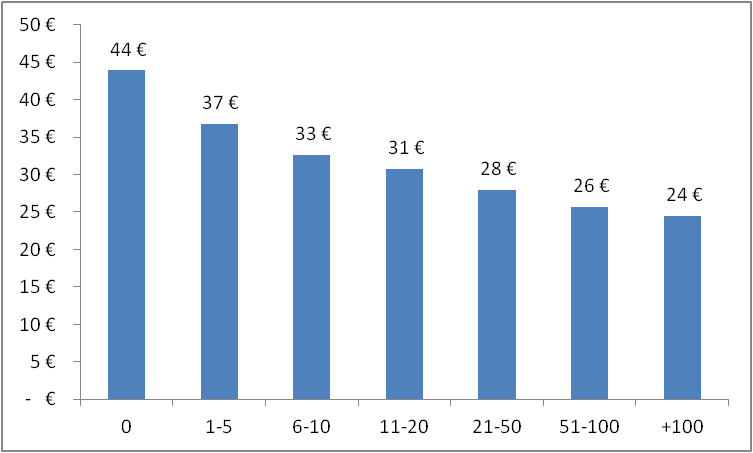

The first aspect of this structuring work involves ensuring that the transactions go smoothly: handling the rental payment system, managing bookings and availability, establishing the interface as the only way to communicate with other members, negotiating an ad hoc insurance contract to cover renters’ use of the vehicle, managing any disputes between private individuals on a case by case basis (fines, damage, etc.). This framing of the exchanges serves not only a functional purpose. It also lightens the workload of participants by taking care of all the aspects that require expertise in buying and selling (carrying out a transaction, negotiating prices, etc.). In doing so, it puts the focus of the exchange on local interactions and local coordination, keeping the primary, monetary motivation of Drivy users at arm’s length. By doing all the calculation work itself and keeping the participants out of it, the site places the exchanges in the giving category (Callon & Latour, 1997) and, more broadly, aligns them with the rhetoric of the collaborative economy. We observed that the most active owners are also those who calculate the most. They precisely assess the costs and income arising from the rental of their vehicle (Excel spreadsheet, depreciation calculation, etc.). They are also the best-placed in price terms: the price for a vehicle that has never been rented is €44 a day, as opposed to €24 for a vehicle that has been rented over a hundred times.

Number of rentals per vehicle and average price

The second aspect of Drivy’s work involves formatting and stimulating supply. The site builds a clear and easy-to-understand catalogue of the vehicles for rent, which involves standardisation and the imposition of qualities (Karpik, 2007) describing the vehicles (brand, model, characteristics, etc.). It also offers owners certain standard market formats to define their product (rental duration, sliding price scale, etc.). In particular, the interface subtly encourages owners to adopt a price grid divided into five-euro increments, a scale which is used for most of the cars on offer.

Price suggestion interface

This formatting of the offer through standardisation does not get rid of the individual characteristics of owners or renters. What it does do is standardise them, a practice found on the majority of collaborative economy sites. That standardisation takes place through a profile page which follows the established conventions of self-presentation (use of first names, photo, age, tastes, usage profile) adapting them to a car rental context, and through a public system for mutual evaluation of members after each rental. Thus, Drivy is formally similar to other market and non-market participatory sites, creating the conditions for building reputation capital that can be directly converted into economic capital.

Co-construction of the market transaction by individuals

How does the co-construction of the transaction between individuals translate into the exchanges between Drivy members? First of all, renters and owners attach great importance to the possibility of conducting the transaction themselves by choosing each other and coordinating with each other. We can see that these roles are constructed, in particular, through asymmetrical self-revelation by participants: while the owner enters little information about themselves on the profile page, concentrating instead on describing the service (vehicle page), half of renters take the trouble to describe themselves on their profile page. This asymmetry in self-revelation can be observed again in the communication and encounters between participants, when the conversation turns to biographical details and the planned use of the vehicle (see the article “The role of sociability in collaborative exchanges” in this issue). In reality, these exchanges serve, above all, to reassure the owner about how their asset will be used. They highlight an imbalance in the roles, since an owner can choose not to rent his vehicle to someone – a choice that traditional market players generally eschew.

This distribution of roles, risks and obligations is reflected in a set of behavioural conventions established between participants: the interviews are peppered with moral considerations about what people should or should not do as an owner (be responsive, pay attention to safety, try to provide a good service) or as a renter (waste the owner’s time, not be punctual, try to negotiate the offer).

Together, owners and renters build a somewhat ambivalent exchange: while the financial aspect is kept at arm’s length by the site, the commercial nature of the transaction remains fundamental. It is manifested in efforts to minimise uncertainty and maximise efficiency by making use of the reputational information Drivy provides. Renters use the reviews posted about the vehicles and their owners to help them make their choice, resulting in most rentals being concentrated on vehicles that have been rented before. Owners, meanwhile, assess the quality of a renter from their description and their efficiency during interpersonal exchanges.

However, this reputation system is not the key to activity on Drivy: 98% of evaluations are positive, reducing the system’s value as a decision aid. Being active, and particularly taking the first steps in using the site (moving from an empty profile with no transactions to an evaluated profile) is actually the best route in to using this market service, a fact which reinforces its participatory nature.

Conclusion

Online P2P vehicle rental is based upon a very specific organisation of commitments and online participation. The market dimension is omnipresent: it is a key motivation for web users – owners and renters alike. It is also the subject of advanced calculations by the most active owners. Nevertheless, this dynamic is glossed over in public, in favour of an interpersonal focus, as embodied by the profile pages and peer evaluations. By taking this approach, Drivy makes full use of the structures and conventions of non-market participation to build and support an activity which is, in fact, taking on a more commercial nature every day. This duality, it seems, is a pillar of the “sharing economy”.